Obtaining a family-based Green Card to live and work in the United States is a process that requires meeting several requirements, including financial sponsorship by a U.S. citizen or lawful permanent resident. This requirement is vital and mandatory as the U.S. government seeks to ensure that new immigrants do not become a public charge in the future.

The Importance of the Affidavit of Economic Sponsorship

The Affidavit of Financial Sponsorship is a critical document in the Green Card process for immediate relatives of U.S. citizens or lawful permanent residents. Although new Green Card immigrants can find employment immediately, the U.S. government requires a financial sponsor to ensure that these immigrants do not rely on public benefits such as food stamps, Medicaid, Supplemental Security Income (SSI) and temporary assistance in the future.

The Immigration and Nationality Act (INA) states that prospective immediate immigrant family members must demonstrate that they are not “inadmissible” on economic public charge grounds. This means that they must have sufficient financial resources to support themselves and not rely on public benefits in the future.

In the event that immigrants use certain public benefits in the future, the agency that provided the benefits may require the financial sponsor to repay that money. Therefore, the Affidavit of Financial Sponsorship is a contract that establishes the sponsor’s responsibility to financially support the immigrant should the need arise.

Sponsor Income Requirements in 2023

When applying for a Green Card for an immediate family member, whether spouse, minor children or parents, the sponsor must complete Form I-864, also known as the Affidavit of Support. This lengthy document serves as a contract between the sponsor and the U.S. government, establishing the sponsor’s obligation to financially support the prospective immigrant if he or she is unable to do so on his or her own.

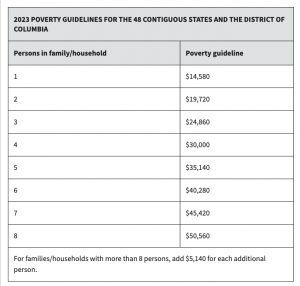

The minimum annual income requirement for 2023 varies by household size and is based on 125% of the federal poverty guidelines. The following are the minimum income requirements to sponsor a spouse or family member for a green card in 2023:

* For two household members, including the sponsor if not in active military service, the minimum annual income requirement is $24,650.

* For sponsoring 2 or 3 family members, the minimum annual income requirement is $30,000 and $35,140, respectively.

See Poverty guidelines here:

https://aspe.hhs.gov/topics/poverty-economic-mobility/poverty-guidelines

It is important to note that both the sponsor and the applicant for permanent residence must provide their most recent tax returns and current income as proof of their ability to meet the income requirements.

If U.S. Citizenship and Immigration Services (USCIS) increases these financial guidelines in the future, it will not affect applications already filed.

Documents for Family Financial Sponsorship of the Green Card

During the Green Card application process, USCIS may request additional evidence to support financial sponsorship. Therefore, it is advisable to submit all necessary documents early to avoid delays in the process.

The following documents are generally required as proof of financial solvency:

* Most recent complete federal tax returns of both the sponsor and the green card applicant.

* Employment letter with recent date.

* W-2/1099 forms.

* Evidence of current salary.

It is essential to submit these documents completely and accurately to support the financial sponsorship and demonstrate the sponsor’s ability to meet the income requirements.

Valid Sources of Income for U.S. Relative Sponsorship

The sponsor’s annual income, which is used to determine income eligibility, is based on the sponsor’s most recent federal income tax return. This total income may include different sources of income, such as wages and salaries, retirement benefits, alimony, child support, dividends, interest earned, and income.

In the event that the sponsor does not have sufficient financial resources to meet the minimum annual income requirement, he/she may include the income of other members of his/her household or family, such as parents, siblings and adult children. In this case, each support person must complete Form I-864A, a contract between the sponsor and the household member to establish this financial commitment.

In some instances, it is also permissible to include the income of a secondary co-sponsor from outside the family, known as a “joint sponsor”. This co-sponsor accepts full financial responsibility for the relative seeking permanent residence in the United States and must file his or her own Form I-864.

In addition to income, USCIS also accepts assets as substitutes for income when the income does not meet the minimum income threshold. However, the assets must be capable of being converted to cash within one year without substantial financial loss. Examples of accepted assets include savings accounts, investments in funds, individual stocks and bonds, certificates of deposit, among others. Foreign assets are not accepted as proof of financial resources.

It is important to note that both the assets and property of the sponsor and other family members living in the household, at least during the last six months, may be considered as proof of financial resources.

In the case of parents of a child under the age of 18 who will obtain U.S. citizenship by derivation upon approval of the Green Card, they will generally be exempt from meeting the minimum annual income requirement. For these cases, Form I-864W is filed to explain the situation.

Conclusion

Obtaining a family-based Green Card in the United States requires meeting several requirements, including financial sponsorship by a U.S. citizen or lawful permanent resident. The Affidavit of Financial Sponsorship is a critical document in this process, as it ensures that new immigrants do not become a public charge in the country.

Sponsor income requirements vary depending on the number of people in the household and are based on federal poverty guidelines. It is critical to submit the required documents completely and accurately to support financial sponsorship. In addition to income, USCIS also accepts assets as proof of financial resources.

Meeting the sponsor’s income requirements is an important step in obtaining a Green Card and starting a new life in the United States. It is advisable to seek the advice of immigration experts to ensure that you meet all requirements and submit a successful application.